Mother’s Day presents a unique opportunity to think beyond traditional gifts and consider options that provide lasting value and financial stability. This Mother’s Day, consider giving your mother a gift beyond mere material pleasure: a monetary investment. Whether fixed deposits, mutual funds, or stocks, these financial instruments provide immediate joy and long-term benefits.

Fixed deposits, Stocks, Mutual Funds

“As a seasoned professional in financial markets, I understand the importance of choosing gifts that offer both sentimental and economic value. Fixed deposits offer a safe and steady return, while mutual funds allow for diversification and the potential for significant growth depending on market conditions. Investing in the stock market can also be rewarding, offering the excitement of equity ownership in promising companies.,” said Dr. Ravi Singh, SVP – Retail Research, Religare Broking Ltd

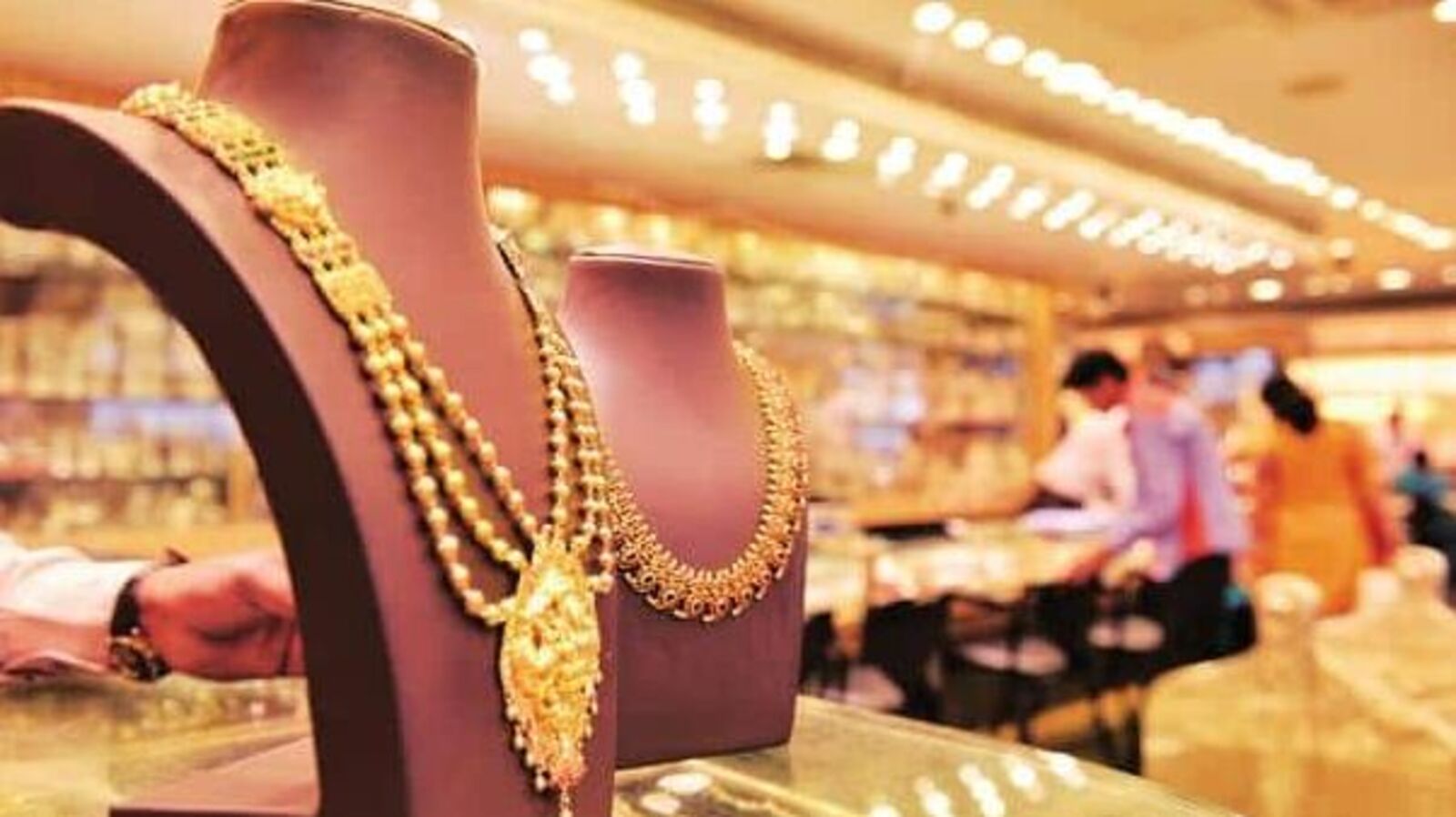

Gold

Additionally, a small allocation towards gold as a precious metal can hedge against inflation and economic volatility, preserving wealth over time.

These financial gifts are not just transactions but meaningful investments into your mother’s future financial security and prosperity. Dr Ravi Singh said by choosing such a thoughtful and impactful gift, you are showing your love and empowering her with economic independence and stability.

Business venture

Consider a unique and empowering gift this Mother’s Day: launching a business venture in your mother’s name, advised by Ashish Agarwal, Director of Acube Ventures.

“Opt for an investment that resonates with her passions or long-held interests, transforming a thoughtful gesture into a source of personal and financial growth. Whether it’s a boutique, café, or creative startup, this venture offers more than just a present—it opens doors to new possibilities,” said Ashish Agarwal.

Real Estate

Aman Gupta, Director, RPS Group

Aman Gupta, Director of RPS Group, makes a compelling point about the dual benefits of gifting property and investing in Real Estate Investment Trusts (REITs). Gifting property serves as a meaningful gesture of gratitude and can be a savvy investment move.

REITs offer a convenient way to gain exposure to real estate without the hassle of direct property ownership. By investing in REITs, individuals can enjoy potential rental income and capital appreciation from various properties, including commercial buildings, residential complexes, and healthcare facilities. This diversification can mitigate risk and provide stable returns over time.

Disclaimer: The views and recommendations made above are those of individual analysts, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 12 May 2024, 06:02 AM IST